$100M Money Models

$100M Money Models by Alex Hormozi is a practical guide designed to help businesses maximize profit from customers quickly and efficiently. Hormozi, a self-made millionaire, shares his “private notes” and proven strategies for building a robust “Money Model” – a deliberate sequence of offers that ensures businesses make more money from customers than it costs to acquire them. The book emphasizes that a well-designed Money Model can eliminate cash as a bottleneck for growth, leading to rapid scaling and profitability.

Main Themes and Core Concepts

1. The Money Model Defined and Its Importance

A “Money Model is a sequence of offers.” At its core, it’s about identifying and solving a customer’s problems at every opportunity. A successful Money Model ensures that a business profits more from a customer than it costs to acquire and service them within the first 30 days, ideally enough to acquire and service multiple new customers. This foundational principle allows for continuous reinvestment and exponential growth.

- Key Idea: “A good Money Model makes more profit from a customer than it costs to get and service them in the first 30 days. That’s the bare minimum.”

- Ultimate Goal: A “$100M Money Model makes more profit from one customer than it costs to get and service many customers in the first 30 days, which removes cash as a limiter to scaling your business.”

- Case Study (Car Rental): Hormozi illustrates this with a car rental experience where a “$19/day car” became a “$100/day” rental due to strategically presented offers for vehicle upgrades, late returns, insurance, and prepaid gas. This highlights how solving perceived problems through a sequence of offers significantly increases customer value.

- Warning: “Bad Money Models Kill Businesses” by costing more to acquire customers than they generate in profit, leading to advertising cuts, cash flow issues, and eventual failure.

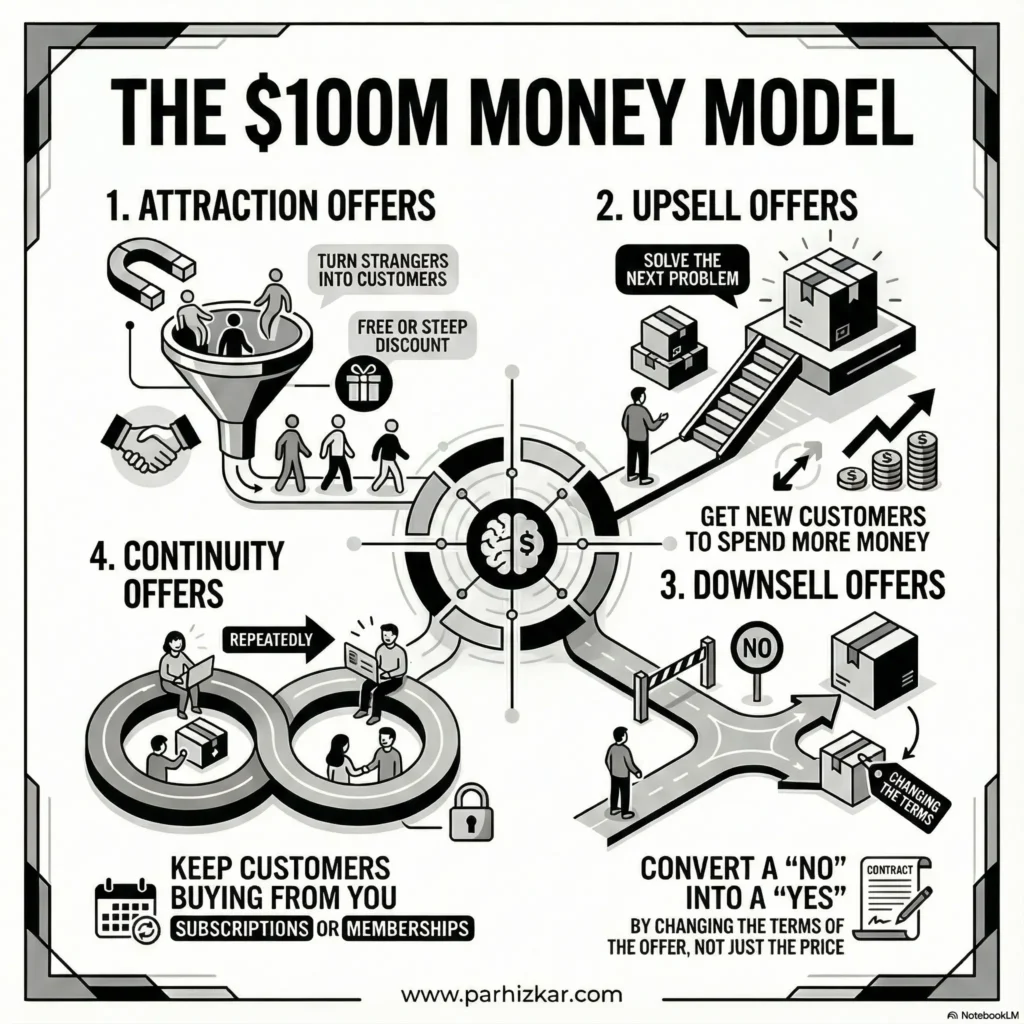

2. The Four Types of Offers

Hormozi categorizes offers into four types, each serving a distinct purpose in the Money Model:

- Attraction Offers: “turn strangers into customers” by offering something free or at a discount to generate leads and make initial sales.

- Upsell Offers: “get people to spend more cash” by presenting solutions to new problems that arise after an initial purchase, increasing immediate profit.

- Downsell Offers: “get people to say yes when they would have said no” by adjusting the offer (price or features) when a customer initially declines a higher-priced option.

- Continuity Offers: “keep people buying” through ongoing value and recurring payments, maximizing the long-term value of each customer.

Hormozi states that his most profitable businesses utilize all four offer types in combination.

3. Stages of Building a $100M Money Model

The development of a Money Model is an iterative process, evolving alongside business growth. It’s not about implementing everything at once, but rather mastering each stage:

- Stage I: Get Cash (Attraction Offers): Focus on reliably acquiring customers and covering costs.

- Stage II: Get More Cash (Upsell & Downsell Offers): Maximize 30-day profits from existing customers.

- Stage III: Get The Most Cash (Continuity Offers): Maximize the total lifetime value of each customer.

This staged approach ensures financial and operational reliability, with each stage funding the next. “Patience is still the fastest way to get to your goal.”

4. Key Attraction Offers (Turning Strangers into Customers)

The goal is to generate enough upfront cash to cover customer acquisition and delivery costs, allowing for scaling.

- Win Your Money Back: Customers pay upfront with the chance to get their money back (or store credit) if they achieve specific results or take certain actions. This significantly lowers customer risk and boosts engagement. “From the data we’ve collected from thousands of gyms, about 10% of all customers will ask for their money back.”

- Tactics: Make criteria easy to track, results-oriented, and business-advertising. Offer store credit over cash. Apply credit over a longer period to encourage continued engagement.

- Giveaways: Advertise a “Grand Prize” to attract leads. A single winner receives the prize, while all other applicants qualify for a discounted “promotional offer” on your core product. This generates high-quality, interested leads.

- Tactics: Grand Prize must be genuinely “Grand.” Give away two prizes if a referral wins for increased lead generation. Create urgency with deadlines.

- Decoy Offer: Advertise a free or discounted, lesser version of your premium offer (the “decoy”). When leads engage, present both the decoy and a significantly more valuable premium offer side-by-side to highlight the premium’s superior value.

- Tactics: Make the contrast “Huge.” “Ask ‘are you here for free stuff or lasting results?’ for permission to offer the premium thing first.”

- Buy X Get Y Free: Offer free items (“Y”) when customers buy a core product (“X”). The key is to strategically price the core product to cover the cost of the free items while making the “free” aspect more appealing than a direct discount.

- Tactics: “Raise Prices Before Giving Stuff Away To Preserve Profits.” Give more free things than paid things. Can mix and match different free items.

- Pay Less Now or Pay More Later: Give customers the choice to pay full price later (with a conditional guarantee) or a discounted price now with bonuses. This removes risk for the customer and gets more upfront payments.

- Tactics: Promise a clear, measurable result for the guarantee. Use a conditional satisfaction guarantee (e.g., must attend training).

- Free Goodwill Offer: An example of how free content and help (like the book itself) builds trust and encourages reviews, which in turn acts as social proof and an indirect attraction mechanism.

5. Key Upsell Offers (Getting More Cash, Faster)

Upsells leverage the “hyper buying cycle” when customers are most excited about a new purchase.

- The Classic Upsell: Offer a solution to the customer’s next problem the moment they become aware of it. “You can’t have X without Y!” This is often the most profitable part of a Money Model.

- Tactics: “Offer More Profitable Upsells First.” Use “Get Them To ‘Say No To Say Yes'” by asking “You don’t want anything else do you?”

- Menu Upsell: Guide customers by telling them what they don’t need (unselling), prescribing what they do need, offering a choice between two preferred options (A/B upsell), and making payment easy with “Card On File.”

- Tactics: Detailed and personalized instructions (prescription upselling). “Make Anything A/B Sellable.”

- Anchor Upsell: Present a significantly more expensive “Anchor” offer first. When the customer “Gasps” at the price, then present your main offer, which now appears as a much better deal.

- Tactics: “Make A Premium Offer You Actually Want People To Buy.” The Anchor should be 5-10x the price of the main offer.

- Rollover Upsell: Credit some or all of a customer’s previous purchases (even from competitors) toward a new, typically more expensive, offer. This re-engages customers and encourages upgrades.

- Tactics: Use “winback campaigns” for old customers. “Do Rollover Upsells before refunding.” Spread credit over time for long-term engagement.

6. Key Downsell Offers (Turning No into Yes)

Downsells ensure that even if a customer says no to a primary offer, there’s a viable alternative that still generates profit.

- Payment Plan Downsells: Instead of discounting, spread the cost of the same product over time through scheduled payments.

- Process: Progress from rewarding full payment (discounts) to 3rd-party financing, credit card, half now/half later, three payments, evenly spread payments, and finally a free trial.

- Tactics: “Reward for paying in full rather than punish for paying over time.” Align payments with paychecks.

- Trial With Penalty: Customers get a free trial if they meet specific terms (actions/results), but pay a fee if they don’t meet them. This incentivizes engagement and converts trial users into paying customers.

- Tactics: “Always Get A Credit Card.” Make check-ins required. Explain fees after getting the card.

- Feature Downsells: Lower the price by removing specific features (quantity, quality, or entire components) rather than just offering a discount. This helps customers find the “best deal for them” and can even “re-upsell” them on the original, higher-priced offer by highlighting the value of the removed feature.

- Tactics: “Never Negotiate The Price” (but adjust features). Standardize the process by cutting valuable features first to make the original offer more appealing. Barter discounts for reviews/testimonials.

7. Key Continuity Offers (Keeping Them Buying)

Continuity focuses on long-term customer value and recurring revenue.

- Continuity Bonus Offers: Attract and retain customers by offering valuable, one-time bonuses for signing up for a recurring membership, along with ongoing monthly bonuses.

- Tactics: “Focus On The Bonus, Not The Membership.” Bonuses should be related to the core offer and ideally existing assets.

- Continuity Discount Offers: Provide free service time (upfront, at the end, or spread out) in exchange for a longer-term commitment to a recurring service.

- Tactics: “Bill weekly (weekly, every 2 weeks, 4 weeks, 12 weeks etc)” to gain 8.3% more annually. “Get Two Forms Of Payment” and use ACH where possible to reduce churn.

- Waived Fee Offer: Charge a significant startup fee for a month-to-month option, but waive the fee if the customer commits to a longer term (e.g., a year). The fee acts as an incentive to commit and a penalty for early cancellation.

- Tactics: Make the fee 3-5x the monthly rate. “Customers will stay longer if leaving costs more than staying.”

Most Important Ideas/Facts

- The 30-Day Profit Rule: The fundamental metric for a healthy Money Model is making more profit from a customer than it costs to acquire and service them within the first 30 days. This enables rapid scaling.

- Solving Problems: Every offer, whether attraction, upsell, or downsell, must genuinely solve a problem for the customer. “If a problem appears, and you can solve it immediately—in exchange for money—do it!”

- “Free” is a Powerful Attractor: Hormozi repeatedly demonstrates that “free” offers generate significantly more interest and leads than discounts, even if the underlying economics are similar (e.g., Buy X Get Y Free).

- The Value of Upsells: The initial offer often doesn’t make the most profit. “your first offer doesn’t always make the profit… You make it on the second, third, and…fourth offers and beyond.”

- Turning “No” into “Yes”: Downsells are crucial for maximizing conversion rates by providing alternatives for customers who initially decline. “No means no for this thing, not no for everything.”

- Ethical Selling: Hormozi stresses transparency, treating customers well, and not “hard selling” weak products. “Don’t lie. You’ll short-change yourself long-term.”

- The “Weekly Billing” Hack: Billing every four weeks instead of monthly generates 8.3% more annual revenue for the same perceived price, a “highest value per word note in this book” that has made millions.

- Money Model as an Evolution: Businesses should build their Money Model in stages, perfecting one offer before moving to the next, ensuring each stage funds the subsequent one.

- Flexibility and Creativity: The offers and their combinations are highly flexible. Hormozi encourages readers to experiment and adapt the models to their specific business, noting that he himself learned many of these from others and tweaked them.

- Focus on Offering Ways to Buy, Not More Products: “It’s less about having 100 products to offer, and more about having 100 ways to offer your product.” This includes leveraging affiliate products to fill gaps without increasing operational burden.

Author’s Personal Journey and Motivation

Alex Hormozi shares his journey from “sleeping on the floor” and being “terrified” with only “$5,000” and a month to live financially, to crossing “$100M net worth at age 31.” His experiences, including defying his father’s wishes, skipping business school, and initially struggling with his gym, underscore the real-world application and personal cost of figuring out these strategies. He emphasizes that “Success is the only revenge” and offers encouragement to struggling entrepreneurs: “You cannot lose if you do not quit.” The book is positioned as a “cookbook for making money” derived from his “private notes” and practical experience.

Alex Hormozi is a successful entrepreneur, investor, and the author of three bestselling books, including “100M Money Models.” He and his wife, Leila Hormozi, are the managing partners of Acquisition.com, a private equity firm that invests in founder-owned, cash-flow-positive businesses. As of 2024, their portfolio companies generate over $200 million in annual revenue.

Hormozi’s initial success came from franchising their boutique gym model to more than 5,000 gyms globally. In 2021, they sold a 66% stake in the company for a $46.2 million valuation, and Alex personally crossed a $100 million net worth by age 31. The couple now focuses on making business education accessible through social media, books, and free courses for entrepreneurs. His books, such as “100M Offers” and “$100M Leads,” have sold over one million copies worldwide. Alex also hosts a top-ranked podcast and provides extensive free video training on platforms like YouTube.

Book details

- Title: $100M Money Models

- Explanatory Title: How To Make Money

- Author: Alex Hormozi

- Publisher: Acquisition.com Publishing

- Publication Date: August 19, 2025

- Print Length: 188 pages

- ISBN-10: 1963349156

- ISBN-13: 978-1963349153

- Category: Advertising / Direct Marketing / Sales & Selling